Right from the beginning, we have always been an asset-managing family office. Asset management has been one of our key competences for decades now. And our asset management range is possibly the easiest way for you to benefit from our competence in implementing investment solutions. Rely on our extensive capital market knowledge and on our expertise in selecting experienced specialists for the individual asset classes. We have regularly received awards for the quality of our asset management.

Equities, bonds, alternative investments or commodities – we conduct a regular, structured analysis of each asset class on the basis of clearly defined factors. A systematic top-down analysis is just as important as a structured bottom-up security selection process. This procedure gives us an investment quota, which defines the return potential and the risks of the relevant investment.

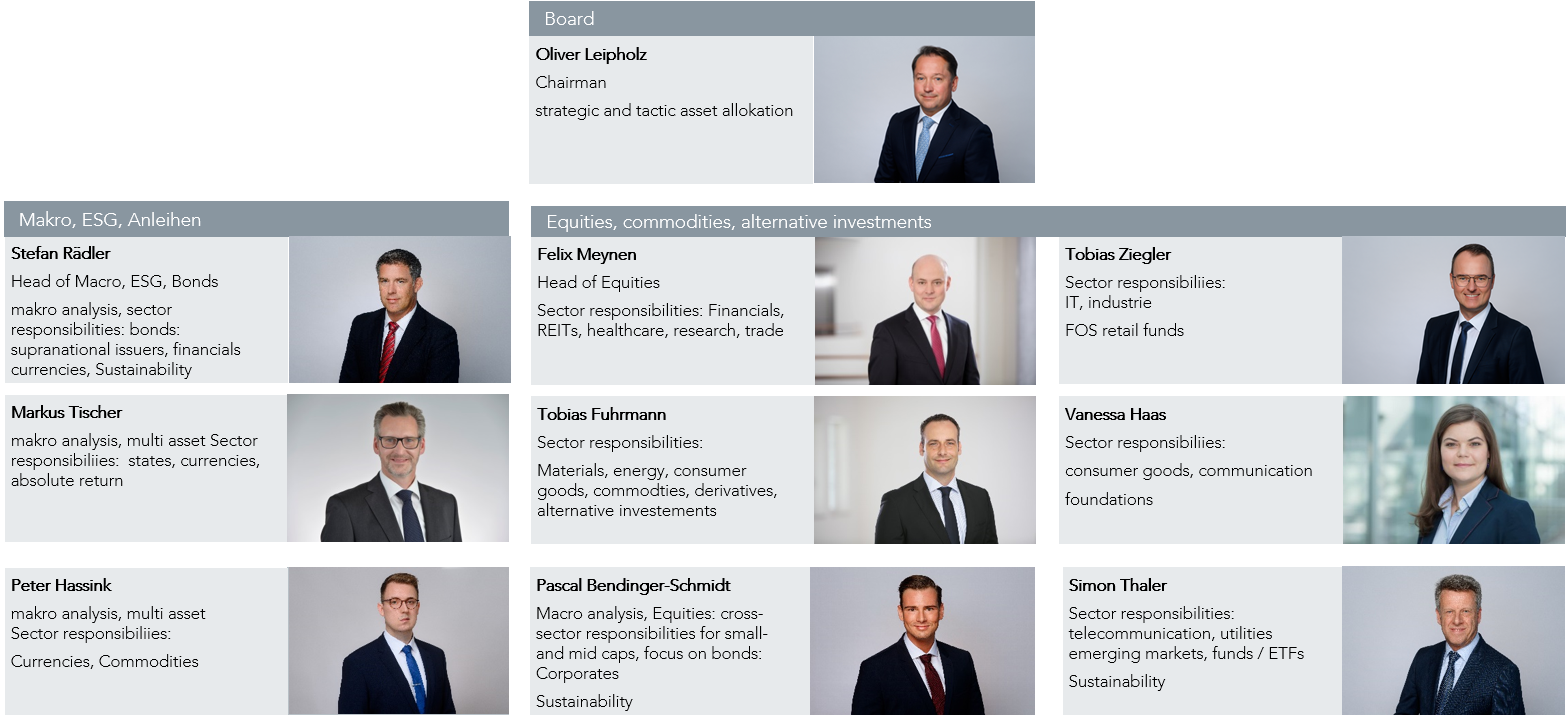

In addition to the stringent investment process, the expertise of our staff and their contacts to analysts and international investment banks guarantee that our services are always of the highest possible quality across all capital market phases.

We focus on blue chips, mainly from the US and Europe. We do not blindly follow market trends, but select companies carefully with a view to the relevance, quality and future viability of the business model. In addition to examining a company’s business model, its operative strength and the quality of its management, we consider its financial health and balance-sheet quality.

At the same time, we focus on so-called mega trends, such as demographic developments, globalisation, digitalisation, artificial intelligence, mobility and climate change. We aim to recognise changes in the framework conditions early on and adapt our investments accordingly. Once we have identified trends, we will implement suitable investments and rely on them in the longer run.

Investments in promising mid caps help to put the finishing touches on the portfolio.

Bonds will help to stabilise the portfolio: government bonds, Pfandbriefe, corporate bonds and inflation-indexed bonds offer a broad range of rating, maturity and features options. A structured investment process enables us to manage the individual investments in the relevant bond segments according to cyclical and debt quality considerations.

The goal is to combine rewarding yields and price gains with good ratings. The selection of bonds for the portfolio depends on a careful risk-return assessment. As a rule, only high-quality issuers are considered.

As the markets change, investment options change and expand as well. Today, investors can use a large number of structured investments which can help to improve returns and diversify strategies. These investments should never be made at random; rather, they should be carefully reviewed and analysed. Once an alternative investment instrument meets the strict requirements of our analysis framework, it may be included in the portfolio.

Commodity investments may help to diversify the portfolio further. The range of available products has broadened considerably over the last few years. By now, it is possible to participate in the development of gold, oil, copper or industrial metals in a simple and cost-effective way. While developments in the commodity sector appear obvious, a careful risk analysis remains necessary. Any investment decisions should be taken carefully in order to use opportunities wisely.