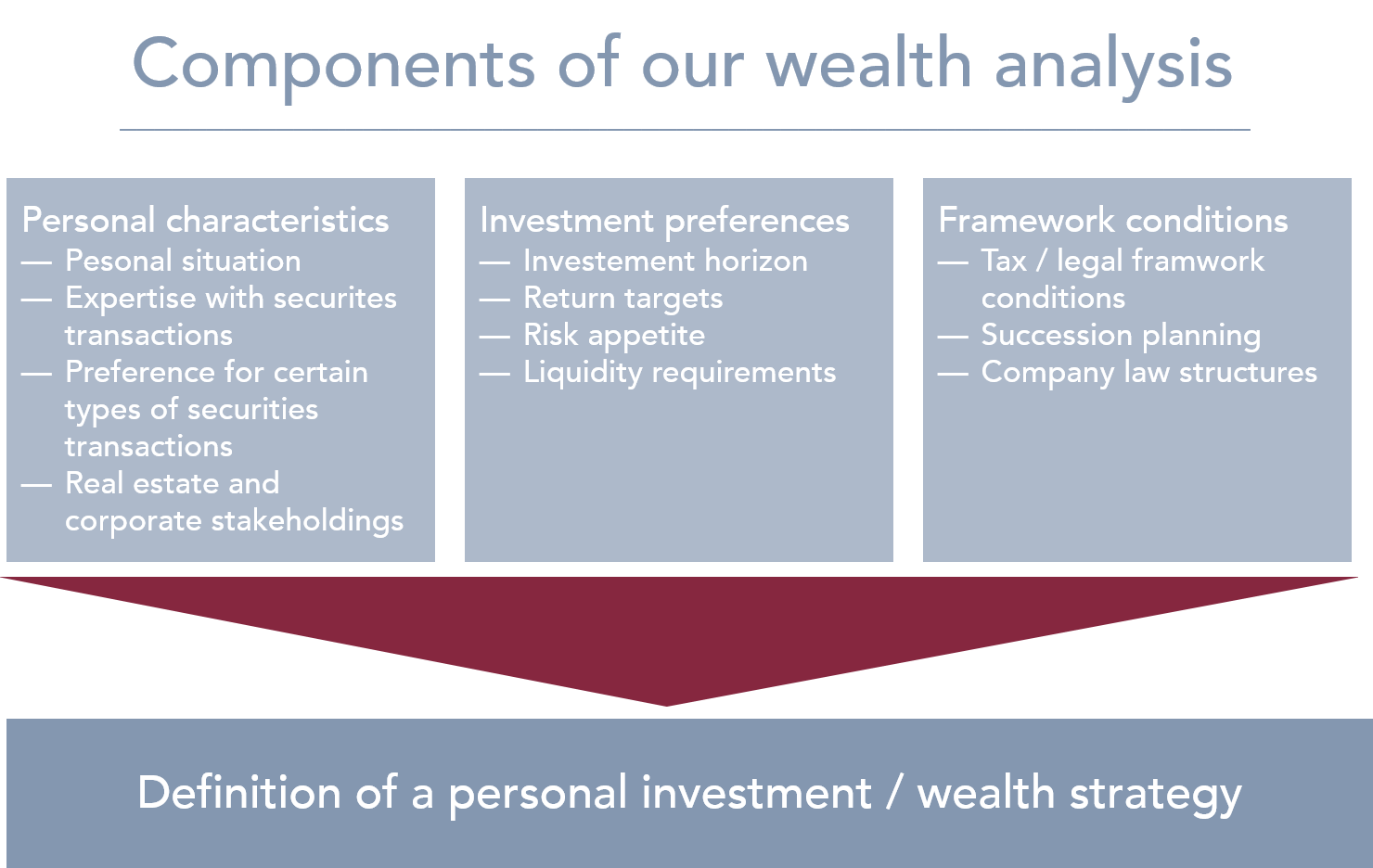

We treat a fortune similar to a company. This approach requires a reliable basis. For that reason, we will begin with a very thorough analysis of your situation, which will cover not only the size and structure of your fortune, but also include (and pay particular attention to) your family situation. After all, different generations may have different requirements and goals. This analysis serves as the basis for your wealth management strategy. The strategy will be regularly reviewed and adapted against the background of the latest market developments and, above all, risks.

We will work together with our clients to develop the framework for the new wealth management strategy. The clients’ investment goals, their investment horizon and risk appetites as well as individual wishes and topics will shape the framework and set the “schedule” for each mandate.

The analysis will focus on understanding, assessing and analysing the current structure of the fortune. This helps to create transparency and provide key drivers for the (re-)orientation of the fortune.

The overarching wealth management strategy often needs to cover a long period of time, as the fortune, its future development and its use are meant to reach across several generations. Your personal goals and our results from the client and fortune analysis from the development of the overarching wealth management strategy. Possible effects from global trends are also taken into account.

Depending on your goals, the strategy may include one or more of the following:

Specialists from other disciplines will be needed for a successful implementation of the overall wealth management strategy and the related measures. As a “manager of managers”, we will support you actively support our clients in all organisational issues related to wealth management:

We provide up-to-date, informative reportings, and our account managers are available at any time, thus ensuring that all potential risks to your fortune are regularly monitored.

If requested, we will be happy to provide additional services: